When a user visits a web page, an ad impression is generated immediately. This moment is gold for publishers because it gives them the opportunity to make real cash. However, to gain the actual value, the ad inventory needs to be seen by a maximum number of advertisers, not in turns, but at the same time. That’s all about header-bidding technology, and that’s why it wins the advertising world in a landslide.

Header-bidding unified auction has gone a long way from mass adoption on the web to the mobile and in-app ecosystem in 2018. Let’s find out what publishers and mobile app developers should expect from technology in 2019.

What is header-bidding?

Header bidding RTB advertising is a technology that helps publishers receive bids from a multitude of advertisers at the same time instead of presenting inventory in turns. In a unified auction, all advertisers have equal bidding opportunities. It increases publisher’s profits and gives advertisers the right to access and pay for the excellent quality inventory before it’s sold in the first round of ‘waterfall.’

How does header-bidding work?

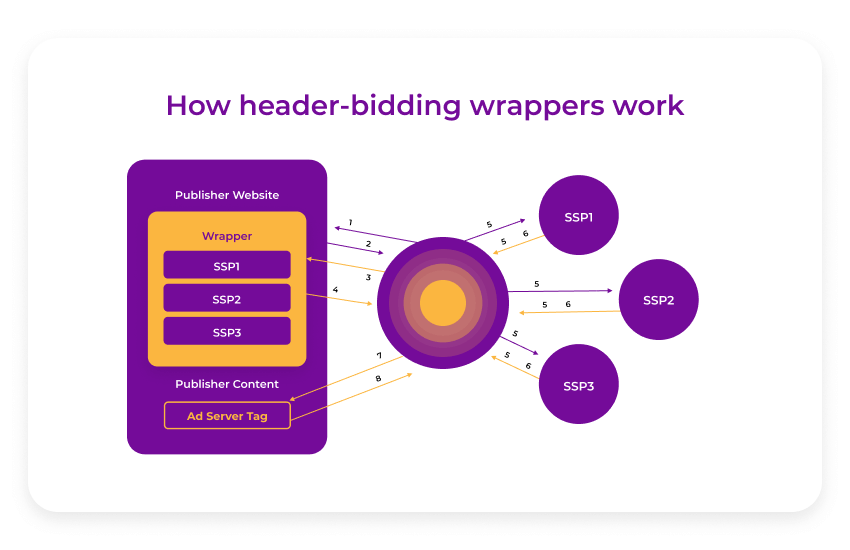

Header-bidding is implemented through the JavaScript library. The header is an HTML element on a publisher’s webpage that stores introductory content (i.e., logo, icon, authorship information) or a set of navigation links. It is a string of code invisible to the end-user.

In simple words, this string of code is embedded in the publisher’s website header. This code pings multiple exchanges and DSPs at the same time. Afterward, the publisher’s SSP selects the highest price at the auction. Header-bidding can be implemented either through client-side or, if necessary, a server-side wrapper that helps to release app resources and positively impact the speed of app/web page loading.

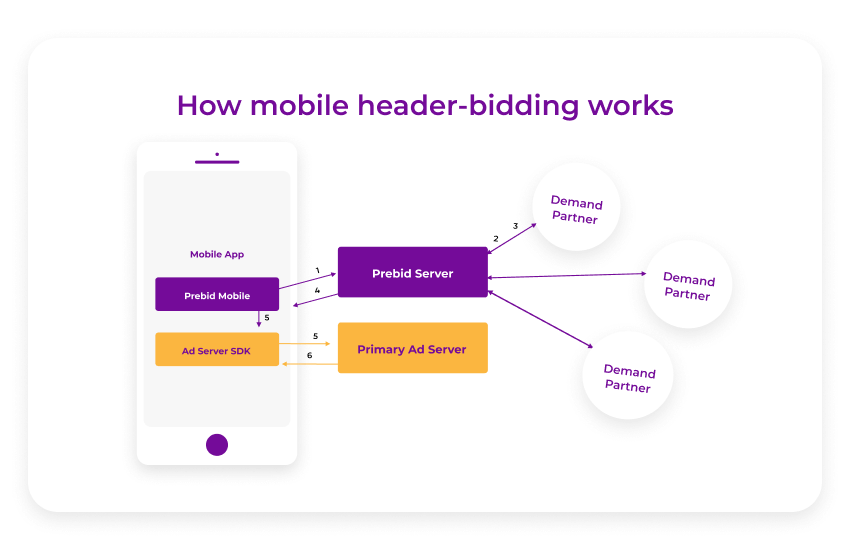

The header-bidding advertising tactic is sometimes called “pre-bidding” or “advanced bidding” because the auction is relocated from the ad server into the header of the publisher’s webpage. If it has to be a mobile header-bidding solution, it works as featured on the picture.

Prebid Server receives a request from Prebid Mobile containing account ID, config ID for all request tags.

Prebid Server is responsible for making and sending Open RTB requests to advertisers.

Prebid Server accepts bid responses from each demand partner (that also includes creatives).

Prebid Mobile receives the bid responses from Prebid Server.

Primary Ad server mobile SDK ensures the Prebid Mobile sets the right value for every slot. The value activates the prebid line units tuned by the ad server.

In case the line item is joined with the Prebid Mobile bid wins, the ad server sends Prebid Mobile creative to the SDK.

Prebid Mobile creative JavaScript retrieves and displays matched creative to the user.

Header-bidding vs RTB waterfall: who wins and why

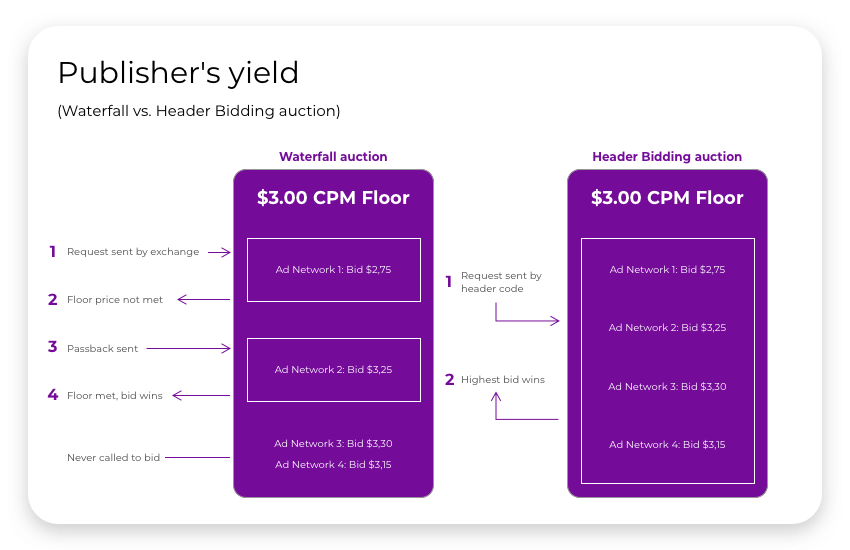

Because programmatic initially was built on the waterfall (sequential bidding), it often caused problems with inventory underestimation and decreased the publisher’s revenue as a result.

In a waterfall auction, when the impression became available, it was offered to the first-tier buyers. If nobody from the first row swallowed the bait, the impression was suggested to the next tier and so on until someone bid on it.

The process of ad prioritization was managed through the publisher’s ad server, which gave preference to advertisers who reserved impressions. Demand partners could compete only for unreserved impressions on a cost-per-thousand (CPM) and fill-rate basis.

Publishers did not receive the real value of their inventory and had to jump from one ad network to another trying to sell the remnant inventory via direct deals or on private auctions.

How header-bidding works for publishers?

Increased competition: Offering impression to the larger number of buyers results in fair competition and higher CPMs. Incorporating the header-bidding solution, publishers see 15 to 100 percent increase in revenues depending on the complexity of their programmatic stack and the number of bidders.

No ad server adjustments: With waterfall auctions, demand fluctuations require constant adjustments. With header-bidding, once the code is inserted into the bidder, publishers do not need to modify it unless they add a new partner to the list.

No demand management: Publishers do not need to manage the order in which demand partners are prioritized because each of them claims the value of the impression in advance.

Reduced latency: Multilayer waterfall programmatic model is inherently latent, and rendering is quite time-consuming. Header-bidding decreases the time for rendering the ad, improving the user experience.

Maximized yield: In a waterfall sales, the value of the impression reduces over time, which is why so much inventory remains unsold. With header-bidding, the value of every inventory is maximized.

Advantages of header-bidding for advertisers

Better viewability on available inventory: In waterfall auctions, advertisers have limited vision of what inventory is available because some of it is sold in private marketplaces or direct deals. With header-bidding, buyers have a 360-degree view of all the inventory available. This creates a unique opportunity to win bids on premium inventory.

Worldwide reach: Accessing inventory at a scale means having the opportunity to advertise to niche audiences and global markets, allowing for much more diversity for targeting potential customers.

Increased transparency. Header-bidding creates a more transparent ecosystem since advertisers can trade with publishers directly without including intermediaries.

Ability to get market insights: Having information on what is available and how much it costs provides advertisers with complete transparency and allows understanding the real value of the targeted audience. If you're interested in the website and blog traffic monetization read this article.

Header-bidding in 2019: revenues, reach, and adoption

According to eMarketer, the overall digital ad spend worldwide reached $273,29 billion in 2018. By the end of 2022, it is expected to surpass the point of $427,26 billion. If we subtract Google’s share of total annual earnings from search engines and the expected share of advertising on Facebook from this number, the publishers will be left with a billion at best. Header-bidding will help to eliminate this imbalance. Over half of the websites involved in programmatic participated in a unified auction last year, and this trend is expected to be valid in 2019.

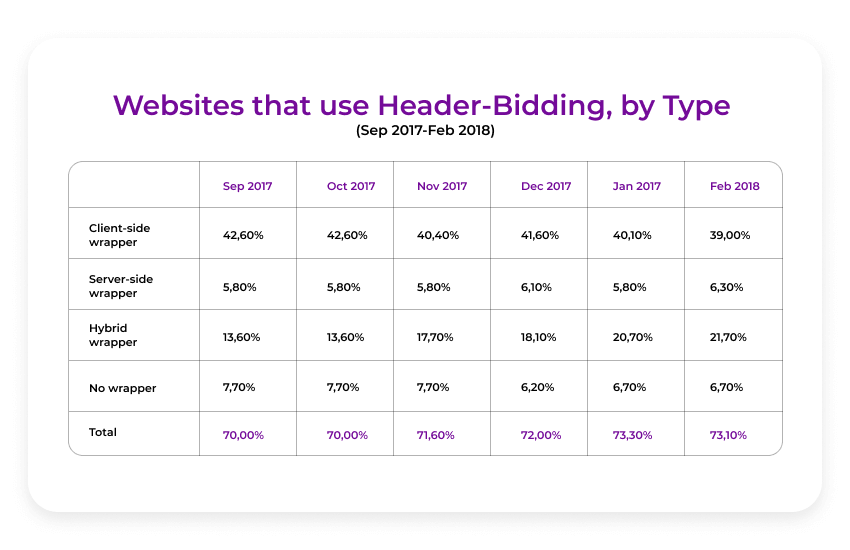

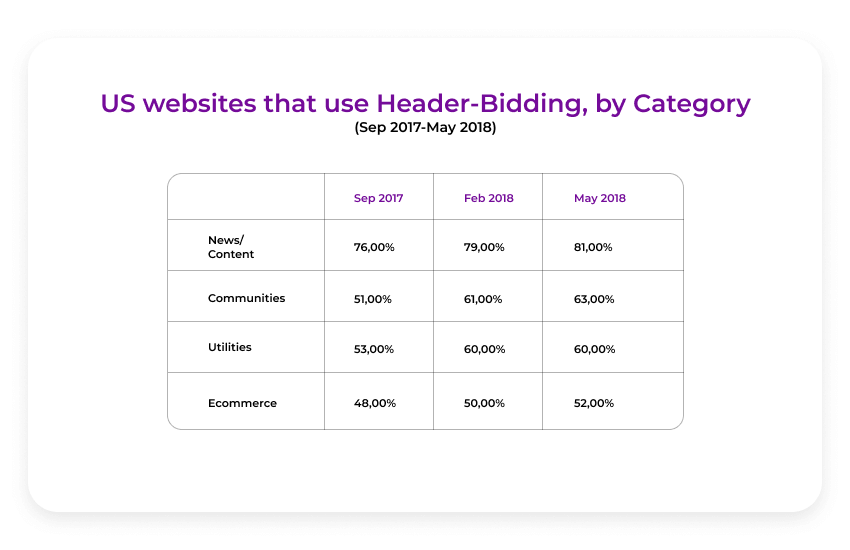

According to eMarketer header-bidding update, news/content, communities, utilities, and e-Commerce were among verticals that used header-bidding RTB technology. By February 2018, 39% of publishers adopted a client-side wrapper, 6,3% have chosen a server-side solution, and 21,1% have opted for a hybrid wrapper that works both server and client-side.

Thanks to the rise of header-bidding and mobile in-app header-bidding solutions we are now experiencing a programmatic renaissance. This gives the whole ecosystem a second chance to implement effective monetization of advertising inventory and provide both advertisers and publishers with competitive, yet beneficial trading conditions.

Implications of latest changes in header-bidding

First-price auctions as a rule of thumb. While the whole world transitions to the first-price auction so does header-bidding. In first-price auctions, advertisers pay the exact price they win the impression with, whereas in second-price the winner pays the second-highest price + 1 cent which opens a gateway for manipulations. In 2019, expect that the majority of header-bidding solutions will go first-price auctions as this way the trading gets more transparent for all parties.

Bid shading is arriving. For many DSPs running on second-price auction, transitioning to the first-price will be technically challenging. Likewise, it will be difficult for advertisers to adjust their bidding strategies at first. As a temporarily measure appeared bid shading practice that evens out the difference between first and second price. In simple words, it is a discount that the winner gets, it prevents media-buyer from potential overpaying.

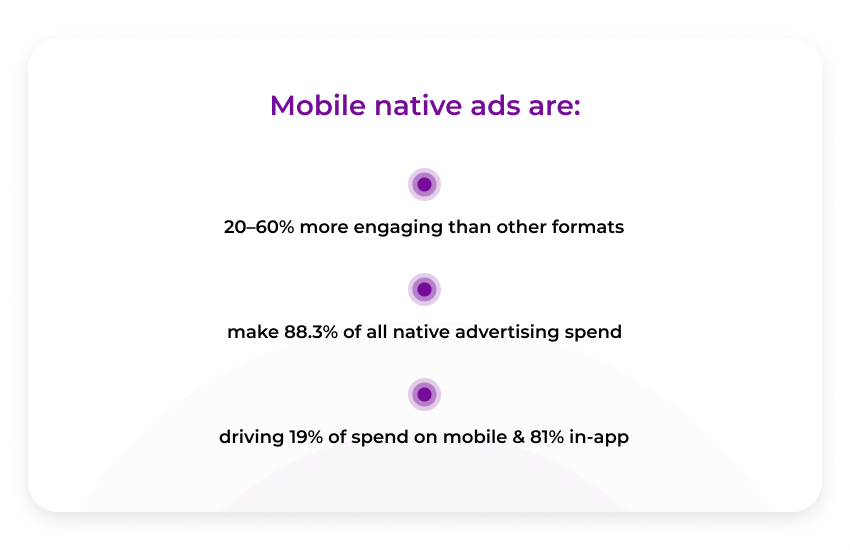

Mobile and native define the future. Header-bidding is no longer a solution for standard display ads. Although traditional banner advertising is convenient and affordable, publishers need to include mobile, native, and interactive video formats in their header-bidding strategy to maximize yield and user engagement in 2019.

How to implement a header-bidding solution?

To implement header-bidding, a publisher has to insert JavaScript code (prebid JS) into the header, which will trigger a request to multiple demand partners. Publishers need just one script for all programmatic players.

When a webpage loads, the code makes a call to ad exchanges or supply-side platforms simultaneously. The script is easily integrated because it is an open-source JavaScript framework and it talks in a universal language.

With header-bidding, the impression is offered to a myriad of buyers. If nobody bids on the impression, it creates a second-price auction. Unsold impressions are passed through on and on until they are sold to the winning bidder. This programmatic solution flattens the waterfall, giving publishers more control over their inventory.

By adding a simple JavaScript code to the head of the page, publishers gain the opportunity to offer their inventory to the massive marketplace of media buyers. They maximize revenues by increased competition.

Integrate our client-side or server-side header-bidding solution and make your inventory available for hundreds of media buyers who will bid in real-time auctions. If you already connected reliable partners through SDK, this won’t be a problem since with our lightweight solution you can retain your old partners and gain the new in the open unified auction.